Hold on to your wallets folks, because artificial intelligence is about to shake up the world of finance once again! With its ability to analyze massive amounts of data at lightning speed and make decisions faster than you can say “bankruptcy”, AI is revolutionizing the way we handle our finances. In this article, we’ll dive into the thrilling world of FinTech and explore the powerful impact that artificial intelligence is having on this ever-evolving industry. So hold onto your hats (and your passwords), because the future of finance is here, and it’s got a whole lot of robot brains behind it.

Overview of Artificial Intelligence in FinTech

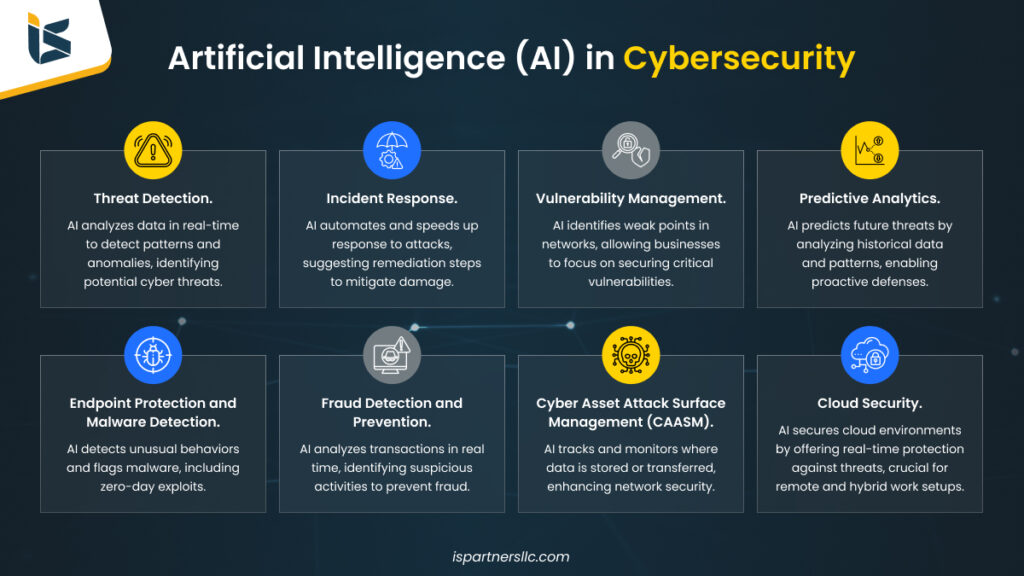

Artificial intelligence (AI) has taken the world of FinTech by storm, revolutionizing the way financial institutions operate. With AI technology, FinTech companies are able to analyze massive amounts of data in real-time, detect patterns, and make predictions with a level of accuracy that would make even a psychic jealous.

One of the key applications of AI in FinTech is in fraud detection. With AI algorithms constantly monitoring transactions for suspicious activity, fraudulent activities don’t stand a chance. It’s like having a team of super sleuths working round the clock to protect your hard-earned money.

AI-powered chatbots have also become a common sight in the world of FinTech. These virtual assistants are always ready to help you navigate through complex financial jargon, answer your burning questions, and provide personalized recommendations. It’s like having a financial advisor in your pocket, minus the hefty fees.

With AI technology continuing to evolve at a rapid pace, the possibilities for its application in FinTech are endless. Whether it’s optimizing investment portfolios, streamlining loan approvals, or revolutionizing customer service, AI is paving the way for a brighter, more efficient future in the world of finance.

Advantages of Using Artificial Intelligence in Financial Technology

Imagine a world where your financial decisions are made by a sentient robot with a knack for numbers and a love for profit. That’s the magic of Artificial Intelligence in Financial Technology! Here are some advantages of letting robots handle your money:

- Speedy calculations: AI can crunch numbers faster than a caffeine-fueled accountant on tax day. No more waiting around for tedious calculations – your financial decisions are made in a split second!

- Round-the-clock monitoring: Forget about taking breaks – AI works 24/7, keeping a watchful eye on your investments and alerting you of any fluctuations in the market. It’s like having a tireless watchdog for your money!

- Unbiased decisions: Robots don’t have emotions or personal biases, which means they make decisions based on cold, hard data. Say goodbye to impulsive purchases and emotional investing - AI has got your back!

So why stress about managing your finances when you can sit back, relax, and let Artificial Intelligence do all the work for you? It’s like having a personal finance wizard living in your computer, ready to make the best decisions for your money. Embrace the future of finance and let AI take the wheel!

Challenges and Risks Associated with AI in FinTech

When it comes to AI in FinTech, there are definitely some hurdles to overcome. One major challenge is the potential for algorithmic bias. After all, machines are only as good as the data they are fed, and if that data is biased, well, we might end up with some pretty questionable financial decisions.

Another risk is the threat of cyber attacks. As AI becomes more integrated into financial systems, hackers are sure to take notice. It’s like putting a flashy sign that says “hack me” in front of your computer, except the sign is actually an advanced AI algorithm that could potentially wreak havoc.

And let’s not forget about the good old fear of the unknown. For many people, AI in FinTech is like trying to decipher ancient hieroglyphics – it’s cool and all, but also pretty intimidating. The fear of the unknown can lead to resistance to adopting new technologies, which could slow down progress in the industry.

Overall, the are no walk in the park. But hey, no one said revolutionizing an entire industry would be easy. So let’s grab our virtual swords and shields and prepare to battle these obstacles head on!

Applications of AI in Different Areas of Financial Technology

From fraud detection to personalized investment advice, AI is revolutionizing the world of financial technology. Let’s dive into some of the most interesting applications of AI in different areas of finance!

First up, we have algorithmic trading. AI-powered trading bots are now making split-second decisions on buying and selling stocks in ways that humans could only dream of. These bots analyze massive amounts of data and patterns to make lightning-fast trades, potentially making or breaking fortunes in a matter of milliseconds.

Next, we have customer service. Chatbots powered by AI are now handling customer inquiries, complaints, and even helping with account management. Who needs a human customer service representative when you have a chatbot that can respond instantly and with unwavering patience, no matter how many times you ask the same question?

Another fascinating application of AI in finance is credit scoring. AI algorithms crunch through an individual’s financial data, spending habits, and even social media activity to determine creditworthiness. It’s like having a digital financial detective digging through your online footprint to assess your trustworthiness as a borrower.

Future Trends and Innovations in AI for FinTech

With the rapid advancement of technology, the future of AI in the FinTech industry is looking brighter than ever. Here are a few trends and innovations that are poised to revolutionize the way we think about money:

- **Quantum Computing:** Imagine a world where financial calculations are done at lightning speeds, thanks to quantum computing. This technology will make complex calculations in real-time, providing more accurate predictions and analysis for financial decision-making.

- **Personalized Financial Advice:** Gone are the days of generic financial advice. AI algorithms will analyze your spending habits, investment portfolio, and financial goals to provide personalized recommendations tailored just for you. Who needs a financial advisor when you have a robot doing all the work?

- **Blockchain for Security:** **Blockchain** technology is already transforming the way we think about security in financial transactions. With its decentralized and tamper-proof nature, blockchain will ensure that your financial data remains secure and protected from cyber threats.

These are just a few of the exciting trends and innovations that we can look forward to in the world of AI for FinTech. Who knows, maybe one day we’ll be making investment decisions based on recommendations from our AI overlords! But until then, let’s embrace the possibilities that AI has to offer in the financial world.

Regulatory Frameworks and Ethics Concerns in AI within the FinTech Industry

When it comes to regulatory frameworks and ethics concerns in the AI within the FinTech industry, it’s like navigating a minefield while trying to juggle flaming swords – not an easy task! One misstep and you could end up facing hefty fines or even legal trouble. That’s why it’s crucial for companies to stay informed and compliant with the ever-changing regulations.

Some key ethical concerns in AI within FinTech include transparency, accountability, bias, and privacy. It’s like walking a tightrope - one false move and you could be facing backlash from both regulators and consumers. Ensuring that algorithms are fair, unbiased, and secure should be a top priority for any FinTech company utilizing AI technology.

Now, you may be thinking, “But navigating these regulatory frameworks and ethics concerns is like trying to solve a Rubik’s Cube while blindfolded!” And you’re not wrong. It’s a complex puzzle that requires constant vigilance and adaptability. But with the right mindset, resources, and a touch of luck, companies can successfully navigate these challenges and emerge unscathed.

Remember, in the wild west of the FinTech industry, where regulations are ever-changing and ethics concerns are always looming, it’s crucial to stay informed, proactive, and ready to pivot at a moment’s notice. So, grab your cowboy hat and saddle up, because the ride ahead is bound to be a wild one!

FAQs

Will AI replace human financial advisors in the future?

No! While AI can assist in providing financial advice, nothing beats the personal touch and emotional intelligence that a human financial advisor can offer. Plus, AI has yet to perfect dad jokes or make a great cup of coffee.

How can AI help detect fraudulent activities in the financial sector?

AI is like the Sherlock Holmes of the financial world! By analyzing vast amounts of data in real-time, AI can sniff out suspicious patterns and behaviors that may indicate fraud. The game is afoot!

What are some ways AI is revolutionizing customer service in FinTech?

Say goodbye to hold music and hello to AI-powered chatbots! These digital helpers can provide instant customer support 24/7, without needing a coffee break or vacation time.

Is AI making financial transactions more secure?

Absolutely! AI can identify potential security risks and anomalies in transactions faster than you can say “fraudulent activity”. It’s like having a cyber-security guard on duty 24/7, but without the snazzy uniform.

How is AI improving the accuracy of credit scoring?

Gone are the days of relying solely on credit history and FICO scores! AI can analyze a myriad of data points to provide a more holistic view of a person’s creditworthiness, helping lenders make more informed decisions. It’s like having a crystal ball, but with fewer fortune tellers.

—

Time to Say Goodbye to Your Piggy Bank!

Well, folks, it looks like we’re in for an exciting ride as artificial intelligence continues to revolutionize the world of FinTech. Say goodbye to your boring old piggy bank and get ready for a future filled with sleek robots managing your finances with the precision of a NASA space mission. Who knows, maybe one day we’ll all be asking Siri to help us pick our next stock investment or teach us how to budget like a pro. So, buckle up and get ready to ride the wave of innovation – the future of finance is looking brighter and more high-tech than ever!