Taxes may be as exciting as watching paint dry or grass grow, but when it comes to corporate taxation, the stakes are higher and the confusion is real. The world of corporate tax law is a tangled web of rules and regulations that would make even the most seasoned tax professional scratch their head in bewilderment. So buckle up, grab a calculator, and let’s unravel the complexities of corporate taxation together – because who said tax season couldn’t be a laugh riot

Understanding the Basics of Corporate Taxation

In the world of corporate taxation, it’s important to understand the basics so you don’t end up owing more money than you can count! Here are a few key things to wrap your head around:

First and foremost, make sure you know the difference between a C corporation and an S corporation. It’s kind of like trying to tell the difference between a regular potato and a sweet potato – one is a bit sweeter than the other (not the corporate taxes, just the analogy).

Next up, deductions are your best friend. Think of them as your corporate tax fairy godmother, waving her wand and magically making some of your tax burden disappear. Just remember to keep track of all your receipts and expenses like a hoarder collects cats – it’ll pay off in the long run!

Lastly, don’t forget about tax credits. These little nuggets of joy can help reduce your tax bill dollar for dollar. It’s like finding a $20 bill in your jeans pocket – except instead of finding it, you get to earn it by being a responsible corporate citizen. Cha-ching!

The Role of Tax Accountants in Corporate Tax Planning

When it comes to corporate tax planning, tax accountants are the unsung heroes behind the scenes. They are the wizards of the financial world, weaving their magic to help businesses navigate the complex maze of tax laws and regulations.

Here are a few key ways tax accountants play a vital role in corporate tax planning:

- Tax Compliance: Tax accountants ensure that businesses comply with all tax laws and regulations, helping them avoid costly penalties and fines.

- Tax Savings: By identifying tax-saving opportunities and loopholes, tax accountants help businesses minimize their tax liabilities and maximize their profits.

- Strategic Planning: Tax accountants work closely with businesses to develop strategic tax plans that align with their financial goals and objectives.

So, the next time you see a tax accountant diligently crunching numbers and poring over tax documents, remember that they are the unsung heroes of corporate tax planning, working behind the scenes to ensure businesses stay financially healthy and profitable.

Key Factors Influencing Corporate Tax Rates

When it comes to corporate tax rates, there are several key factors that influence just how much a company will have to cough up to the taxman. Let’s break down some of the biggest influencers:

- Government Policy: Ah, politicians. Always finding new ways to squeeze money out of businesses. The tax policies set by the government can have a major impact on corporate tax rates. And let’s be honest, they’re never in favor of letting businesses keep more of their hard-earned cash.

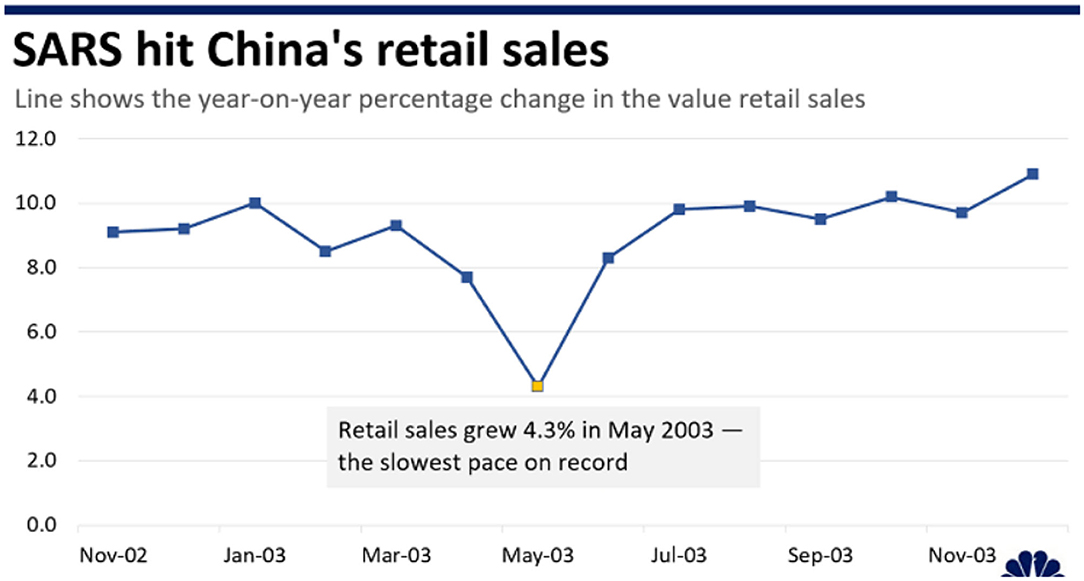

- Economic Conditions: When the economy is doing well, corporate tax rates tend to be higher. Because, you know, businesses are making more money. But when the economy takes a nosedive, suddenly everyone wants to give companies a break. Go figure.

- Industry Regulations: Different industries face different tax rates, depending on who has the biggest lobbying power. So if you’re in an industry that’s good at convincing politicians to cut taxes, you’re in luck! Otherwise, well, better start schmoozing.

At the end of the day, corporate tax rates are a necessary evil for running a business. Who knew that making money could be so expensive? But hey, at least you can write it off as a business expense, right?

Tax Credits and Incentives for Corporations

Looking for ways to save money? Look no further than ! These little gems can help your company keep more of its hard-earned cash in its pocket. Here are a few juicy details to get you excited:

First off, did you know that some states offer tax credits for hiring local employees? That’s right – by supporting your community, you can also support your bottom line. It’s a win-win! Plus, hiring locally means you don’t have to deal with those pesky relocation expenses.

Next up, let’s talk about research and development tax credits. If your company is constantly innovating and coming up with new products or services, you could be eligible for some serious tax savings. It’s like getting rewarded for being a total genius – how cool is that?

And don’t forget about green energy incentives! By using renewable energy sources or implementing eco-friendly practices, you can not only help save the planet but also pad your pockets with some sweet tax benefits. Who knew being environmentally responsible could be so profitable?

Navigating International Taxation Laws for Multinational Corporations

Embarking on the tumultuous journey of can often feel like you’re trying to solve a Rubik’s Cube blindfolded – while riding a unicycle. But fear not, intrepid tax warriors, for I am here to guide you through the treacherous waters of global taxation with wit and wisdom!

One of the most important things to remember when facing the dizzying array of international tax regulations is that each country has its own unique set of rules and regulations. It’s like trying to speak Klingon in a room full of Quidditch players – confusing, but not impossible. Stay on top of the game by researching and understanding the specific tax laws of each country where your corporation operates.

Another key to successful navigation of international taxation laws is to establish a strong network of tax professionals in each country you do business in. Think of them as your own personal A-Team of tax experts – ready to swoop in and save the day whenever you encounter a financial roadblock. With their knowledge and expertise, you’ll be able to smoothly sail through the choppy waters of global tax compliance.

Remember, when it comes to international taxation laws for multinational corporations, knowledge is power. Stay informed, stay connected, and most importantly, stay calm in the face of tax season chaos. With a little bit of humor and a whole lot of determination, you’ll be able to conquer the world of global taxation like a boss!

Strategies for Minimizing Corporate Tax Liability

When it comes to reducing your corporate tax liability, it’s important to think outside the box. Here are a few unconventional strategies to keep your tax bill as low as possible:

- Get Creative with Deductions: Don’t limit yourself to the standard deductions. Get creative and think about how you can claim deductions for things like office snacks, office pets, or even office ping pong tables. Remember, if you can argue that it’s necessary for your business, it’s probably deductible!

- Invest in Research and Development: Want to lower your tax bill and stay ahead of the competition? Invest in research and development. Not only will you be able to deduct these expenses, but you’ll also be creating innovative new products or services that can give you an edge in the market. Win-win!

- Consider Incorporating in a Tax-Friendly Location: If you’re feeling particularly adventurous, why not consider incorporating in a tax-friendly location like the Cayman Islands or Bermuda? While this may not be feasible for every business, it’s certainly an option worth considering if you want to drastically reduce your tax liability.

Remember, when it comes to minimizing your corporate tax liability, the sky’s the limit (unless, of course, you’re deducting expenses related to a private jet)! So get creative, think outside the box, and start slashing that tax bill.

FAQs

Why do corporations pay taxes?

Oh, corporations pay taxes for the same reason you do – to keep the government off their backs! Just kidding (kind of). Corporations pay taxes to contribute to the society that allows them to thrive and to fund essential government services.

How do corporations use tax deductions to lower their tax bills?

It’s all about getting creative, my friend! Corporations can use a variety of deductions like expenses related to the business, employee wages, and even depreciation of assets to reduce their taxable income. It’s basically like playing a game of hide-and-seek with the IRS!

What are tax loopholes, and how do corporations take advantage of them?

Tax loopholes are like secret passageways in a castle that only the elites know about. Corporations can exploit these legal loopholes to reduce their tax burden, whether it’s through offshore tax havens, complex accounting techniques, or lobbying for beneficial tax breaks. It’s like finding a cheat code in a video game – but with higher stakes!

Why do some corporations pay little to no taxes?

Well, it’s all part of the game, my friend! Some corporations have mastered the art of tax evasion by utilizing loopholes, deductions, and other shady tactics to minimize their tax liability. It’s like they’ve found the ultimate cheat code while the rest of us are stuck playing on hard mode!

How do changes in tax laws impact corporate taxation?

When tax laws change, it’s like a plot twist in a thriller movie for corporations. They have to adapt quickly to navigate the new rules and regulations, which can either result in a windfall of savings or a nightmare of increased tax liabilities. It’s like trying to solve a puzzle with constantly shifting pieces!

—

And there you have it!

Hopefully, this article helped shed some light on the labyrinth that is corporate taxation. Remember, even though it may seem like a complicated puzzle, with a little knowledge and some expert advice, you’ll be able to navigate through those tax forms like a pro. So go forth, arm yourself with knowledge, and conquer those corporate taxes like the financial warrior you truly are!

And always remember, when in doubt, consult a tax professional or maybe just go cry in a corner. Whatever works for you!