Welcome, fellow adventurers, to the wild and wonderful world of asset management! Like navigating a dense jungle filled with hidden traps and treacherous terrain, successfully managing your assets can be a daunting task. But fear not, dear readers, for with a little bit of wit, a touch of creativity, and a whole lot of strategy, you’ll be well on your way to mastering this complex and captivating realm. Strap on your boots, sharpen your machete, and get ready to delve into the thrilling adventure that is asset management!

Understanding the Basics of Asset Management

So, you’ve decided to dip your toes into the world of asset management, huh? Well, buckle up because you’re in for a wild ride! But don’t worry, understanding the basics doesn’t have to be rocket science (although, rocket scientists probably do use asset management in some way).

First things first, let’s talk about what exactly asset management is. In simple terms, it’s like being the Marie Kondo of your financial assets – you want to keep only the things that spark joy and get rid of the rest. Of course, in this case, we’re talking about investments, properties, and other valuable assets, not old t-shirts that don’t fit.

Now, when it comes to managing your assets, organization is key. You want to keep track of all your investments, properties, and other valuable items in one central location. Think of it as your own personal treasure map, but instead of buried gold, it’s just a spreadsheet with a bunch of numbers on it. Hey, at least you can’t get attacked by pirates!

Remember, asset management is all about making sure your wealth is working for you, not the other way around. So, get out there, dive into the world of asset management, and watch your wealth grow (hopefully not like a weed, though – those are hard to get rid of).

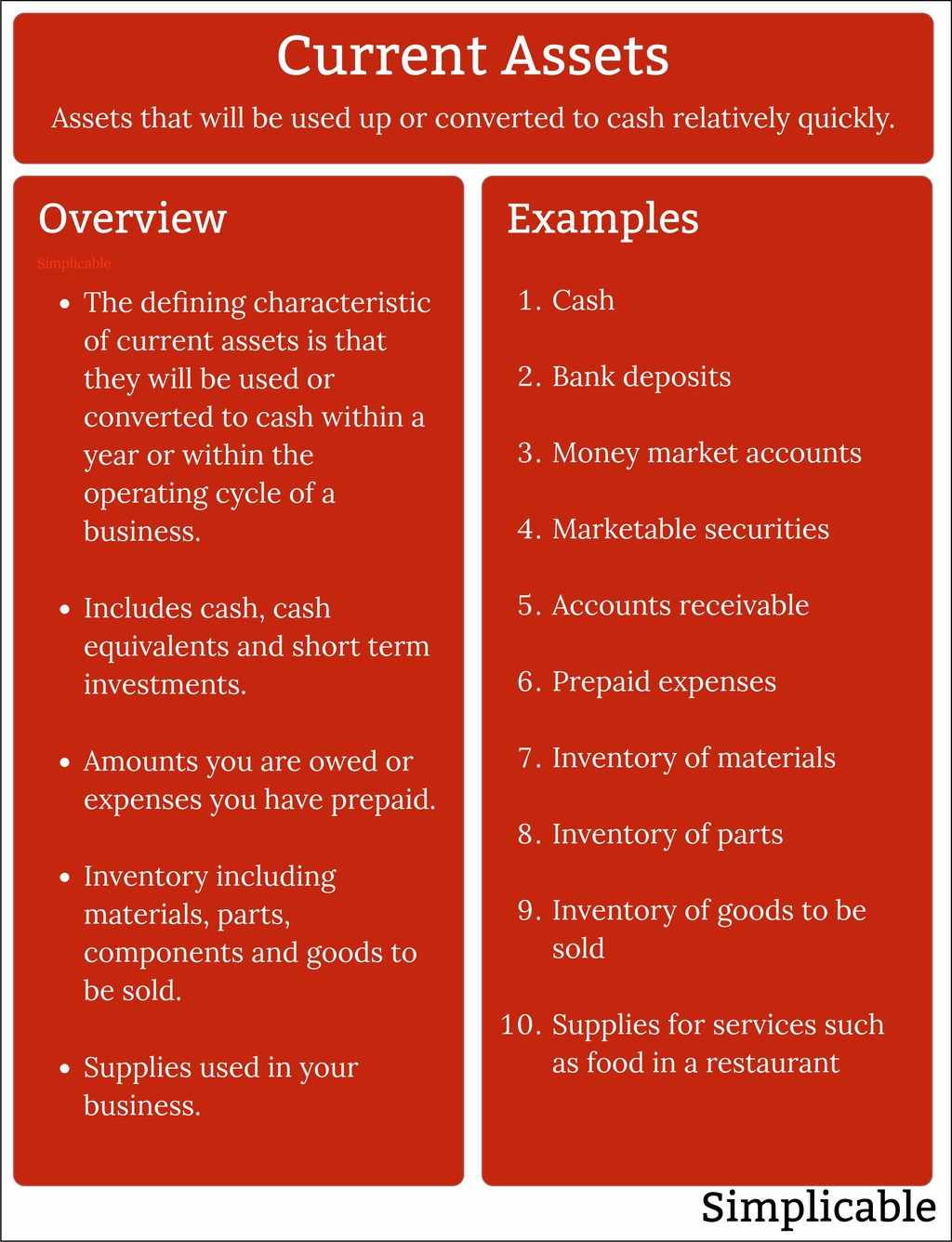

Identifying Different Types of Assets

So you think you know your assets? Well, buckle up buttercup because we’re about to dive into the wild world of !

First up, we have financial assets - these bad boys include stocks, bonds, and cash. They’re like the cool kids of the asset world, flaunting their returns and making everyone jealous.

Next, we have physical assets – think real estate, cars, and even that vintage Beanie Baby collection you’ve been hoarding. These assets are like the backbone of your portfolio, solid and dependable (well, maybe not the Beanie Babies).

And finally, we have intangible assets – these are the mysterious ones, like patents, trademarks, and even goodwill. They’re like the unicorns of the asset kingdom, rare and magical… and sometimes a little elusive.

goals-and-objectives“>Setting Clear Investment Goals and Objectives

So, you’ve decided to dip your toes into the exciting world of investing? Well, buckle up because it’s going to be a wild ride! To start off on the right foot, it’s important to set clear investment goals and objectives. After all, you wouldn’t embark on a road trip without a destination in mind, right?

Think of your investment goals as your GPS, guiding you towards financial success. Whether you’re aiming for early retirement, a dream vacation, or simply want to grow your wealth, having a clear roadmap will keep you on track.

Now, when setting your investment goals, make sure they are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to be rich,” set a specific goal like ”I want to have a net worth of $1 million in 10 years.” This way, you can track your progress and celebrate your achievements along the way.

Remember, investing is a long-term game, so patience is key. Rome wasn’t built in a day, and neither will your investment portfolio. Stay focused, stay disciplined, and soon enough, you’ll be reaping the rewards of your hard work. So, set those goals, make a plan, and get ready to conquer the financial world!

Implementing a Diversification Strategy

So you’ve decided to take the plunge and diversify your strategy, huh? Good for you! You’re about to enter the thrilling world of spreading your eggs into multiple baskets, like a overly cautious chicken.

First things first, you’ll need to assess your current portfolio and identify areas where you’re heavily concentrated. Think of it like a game of musical chairs, but instead of a chair being taken away, you want to add more chairs to the mix. Diversification is like the ultimate safety net – when one investment is down, another is up, balancing everything out like a high-stakes game of financial seesaw.

After identifying potential areas for diversification, it’s time to do some research. Explore different industries, markets, and asset classes to see where you can spread your wealth. Maybe try your hand at investing in art, cryptocurrencies, or even rare Beanie Babies – the sky’s the limit! Just remember, diversification is all about spreading the risk, not putting all your eggs in one basket (unless you’re that overly cautious chicken).

Once you’ve identified your new potential investments, it’s time to take the plunge and start diversifying. Don’t be afraid to shake things up and try new things – after all, variety is the spice of life! Embrace the diversity in your portfolio like a colorful bouquet of investments, each one adding a unique flavor to your financial future. Who knows, maybe your Beanie Baby collection will be the thing that saves your bacon in the next market downturn!

Leveraging Technology in Asset Management

So you’ve decided to up your asset management game by leveraging technology? Good for you! Let’s dive into some ways you can make the most out of this digital revolution:

First things first, automation is your best friend. Say goodbye to tedious manual tasks and let technology do the heavy lifting for you. With automated processes, you’ll have more time to focus on strategic decisions and less time dealing with paperwork.

Next up, consider data analytics. Harness the power of data to gain valuable insights into your assets and make more informed decisions. By analyzing trends and patterns, you can optimize your asset performance and maximize returns.

And don’t forget about cloud computing. Embrace the flexibility and scalability that cloud technology offers. Store your data securely in the cloud and access it from anywhere, anytime. Plus, with cloud-based asset management software, collaboration with your team has never been easier.

Monitoring and Evaluating Performance

So you’ve set your team up for success with clear expectations and goals. Now comes the fun part – ! Here are some tips to keep things running smoothly:

First off, keep track of progress using dashboards and reports. These visual aids can help you quickly spot areas that need improvement, or celebrate wins with your team. Plus, they make you look super smart in front of your boss.

Next, don’t forget to provide feedback regularly. It’s like watering a plant – neglect it and it’ll wither away. But give it love and attention, and you’ll have a thriving team in no time. Just make sure your feedback is constructive, or you might end up being the office villain.

Lastly, celebrate achievements! Whether it’s hitting a deadline, securing a big client, or just surviving another Monday, take the time to acknowledge your team’s hard work. Throw a pizza party, break out the glitter, or do a happy dance – whatever it takes to keep morale high.

Adapting to Changing Market Conditions

In this ever-changing business landscape, it’s crucial to stay on top of market conditions to ensure your company thrives. Here are some tips to help you adapt and succeed:

Don’t be afraid to pivot – sometimes, you need to change course to stay relevant. Whether it’s changing your product offerings or targeting a new audience, embrace the change and adapt accordingly.

Be flexible – market conditions can shift in the blink of an eye, so it’s important to remain agile. Keep an open mind and be willing to try new strategies to keep up with the changing times.

Stay informed – knowledge is power, so be sure to stay updated on the latest industry trends and developments. Attend conferences, read industry publications, and network with other professionals to stay ahead of the curve.

Embrace innovation – don’t be afraid to try new things and think outside the box. Innovation is key to staying competitive in today’s fast-paced market, so be bold and dare to be different.

In conclusion, is all about being proactive, flexible, and innovative. By embracing change and staying ahead of the curve, you can position your company for long-term success. So stay on your toes, keep an eye on the market, and be ready to pivot when necessary.

FAQs

How do I determine the best asset management strategy for my financial goals?

Well, it all starts with a magic eight ball and a crystal ball. Just kidding! The best way to determine the right strategy for your financial goals is to first clearly define what those goals are. Once you have a clear picture of what you want to achieve, you can work with a financial advisor to create a customized plan that aligns with your objectives.

What are the key factors to consider when choosing an asset management firm?

When choosing an asset management firm, you’ll want to consider their track record, fees, investment philosophy, and how well they align with your goals and risk tolerance. And of course, it never hurts to see if they have a secret handshake or a cool logo – just kidding! The key is to do your research and make sure you feel comfortable entrusting your hard-earned money to them.

How can I stay informed about changes in the market that could impact my assets?

One word: Twitter! Just kidding. While Twitter can be a helpful tool for staying informed, it’s also important to have a solid news source or financial advisor that you trust. Reading up on market trends, economic indicators, and staying in touch with your advisor can help you stay ahead of the curve and make informed decisions about your assets.

What are some common mistakes to avoid when managing assets?

One common mistake is letting your emotions drive your investment decisions. Remember, investing isn’t a roller coaster ride – unless you’re investing in a theme park, in which case, can we join you? It’s important to stick to your long-term plan and not let fear or greed cloud your judgment. Another mistake is putting all your eggs in one basket – unless those eggs are solid gold, in which case, can we borrow some? Diversification is key to managing risk and protecting your assets from market fluctuations.

How often should I review and reassess my asset management strategy?

As often as you review your ex’s Instagram profile – just kidding! Reassessing your asset management strategy should be done on a regular basis, typically at least once a year. However, it’s also a good idea to review your strategy whenever there are major life changes, such as getting married, having kids, or discovering your long-lost billionaire uncle – in which case, can we be your new best friend?

—

Good Luck Out There, Asset Adventurers!

Well folks, congratulations on taking the plunge into the wild and woolly world of asset management. Remember, it’s a jungle out there, but armed with the proper knowledge and tools, you’ll be swinging from vine to vine in no time.

So go forth, brave asset adventurers, and conquer the complexities of asset management with confidence and a sense of humor. And always remember: keep your eye on the prize, your spreadsheets organized, and your sense of humor intact. Happy asset managing!